GSA Health & Dental Insurance Plan

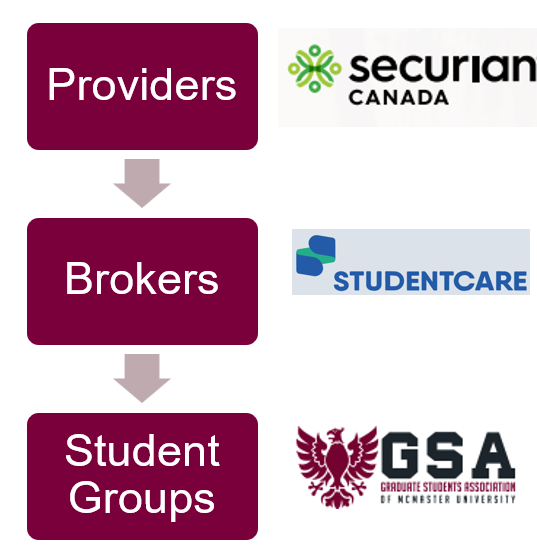

Insurance Relationship

The medical cost in Canada is very expensive. Example: Semi-private ward in hospital: $260/day. The best way to handle it is to buy insurance.

As students, we don’t need to negotiate with insurance companies directly. Since we’re not familiar with insurance companies, insurance products, whether the price is reasonable and so on. Instead, the related organization or group has already prepared the corresponding insurance services in advance.

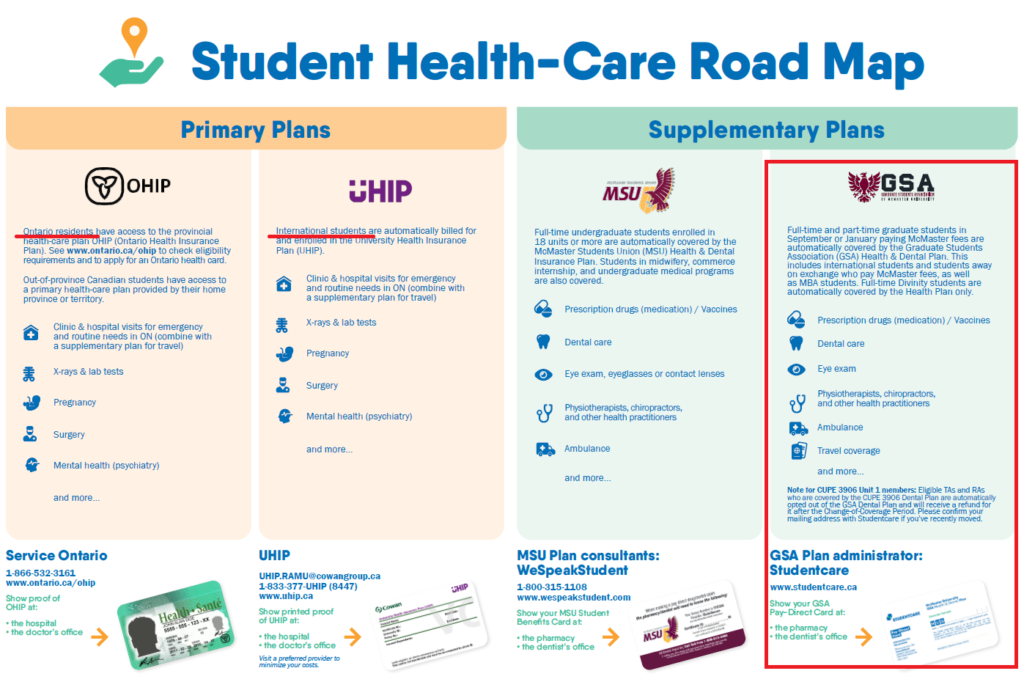

According to the following figure, GSA insurance involves three different organizations, namely Providers, Brokers, Student Groups.

Providers: Providers are insurance companies. Many insurance companies offer a wide range of insurance products. The insurance companies associated with us are

- Securian Canada: https://students-healthportal.securiancanada.ca/

Brokers: Brokers play a role as a bridge. They combine the corresponding insurance products of each insurance company and recommend them to different customer groups.

Customers don’t have to know which insurance companies to go to when they reimburse medical cost. They just need to send the bill to the broker, and the broker will transfer them to the appropriate insurance company. The broker associated with us is

- Studentcare: https://www.studentcare.ca/

Student Groups: If only a few people buy the insurance, the cost of insurance will be very high. However, when a lot of people buy it together, everyone’s price will be cheap. The insurance we buy is always associated with a group, i.e., graduate students.

Insurance List

Graduate students usually buy 2 insurances:

- GSA Health Insurance Plan

- GSA Dental Insurance Plan

The above 2 health insurances are so called “extended health”. The official website of GSA Insurance Plans: http://studentcare.ca/rte/en/McMasterUniversity_Home

Cost of GSA members:

Cost of the family of GSA members:

GSA Health Insurance Plan

GSA Health Insurance Plan provides coverage for those cost that UHIP cannot reimburse, such as prescription drugs. Therefore, those reimbursements will be handled by GSA Health Insurance Plan. Usually, the prescription drugs and UHIP non-reimbursed vaccines can be reimbursed 80% of the total cost by the GSA Health Insurance Plan.

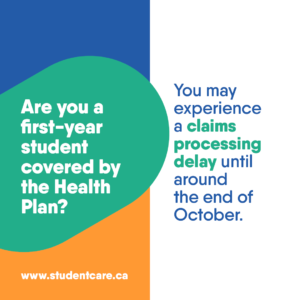

Importance Notice: Due to the time required to process pertinent documents, the reimbursement for newly enrolled graduate students will commence on October 1, 2023.

Health benefit: http://studentcare.ca/rte/en/McMasterUniversity_Health_HealthCoverage

- Prescription Drugs and Vaccinations: Up to 80% coverage, $3,000 maximum per policy year

- Accidents & Emergencies: Ambulance service, travel accident, dental accident, and accidental death & dismemberment

- Health Practitioners: Physiotherapists, chiropractors, massage therapists, and more

- Medical Equipment: Crutches, wheelchair rental, hospital-type bed, and more

- Diagnostic Services: Lab tests, x-rays, and ultrasounds used to diagnose an illness and performed in a commercial lab

Vision: http://studentcare.ca/rte/en/McMasterUniversity_Vision_VisionCoverage

- Eye Exam: $50 per policy year

- Independent Specialists: 30% off prescription eyeglasses, up to $75

- Clearly: 10% off contact lenses, 25% off eyeglass frames

- LASIK MD: Save up to $200 on laser vision correction

Travel: This is very important for those students who publish papers during graduate studies and need to go to other countries to attend international conferences. For more information, see http://studentcare.ca/rte/en/McMasterUniversity_Travel_TravelCoverage

- Note: it does not cover the medical cost in the home country of international students.

- Vacations: 120 days per trip and up to $5,000,000 per lifetime

- Trip Interruption: $5,000 for trip interruption

- Exchange & Internship Students: Travel health coverage for the duration of an academic exchange or internship, plus for the first 120 days of the trip and for 120 days after the end of the exchange or internship

- Trip Cancellation: $1,500 for trip cancellation

GSA Dental Insurance Plan

GSA Dental Insurance Plan offers various dental coverages, including teeth cleaning, repair and other services. Your Plan will cover at least 70% of your dental costs.

Webpage: http://studentcare.ca/View.aspx?locale=en&uid=McMasterUniversity_Dental_Test2&random=538&

Benefits:

- Dental Coverage: $750 per policy year for dental visits

- Dental Accident: Repair/replacement of natural teeth damaged through an external accidental blow to the mouth

- Studentcare Dental Network: Studentcare Dental Network members offer 20% to 30% off dental services

Student Assistance Program

GSA also provides access to mental health services through CONVERSATIONS. It is a confidential mental health and well-being service offered virtually, with no waiting lists or additional fees! Visit www.studentcare.ca for details and eligibility. Otherwise, download the Dialogue app or go to www.studentcare.ca/dialogue to sign up now.

Enroll & Opt-out

Enroll

All graduate students must buy insurances, and the university will automatically charge relative fees at the beginning of the academic year. The specific insurances graduate students need to buy are as follows:

- non-MBA graduate students without TA or RA:

- UHIP

- GSA Health Insurance Plan

- GSA Dental Insurance Plan

- Student Assistance

- non-MBA graduate students with TA or RA

- UHIP

- GSA Health Insurance Plan

- CUPE Unit 1 Dental Plan

- Student Assistance

- Visiting student

- UHIP Premium

- GSA Health Insurance Plan

- Divinity college student

- UHIP

- GSA Health Insurance Plan

Note:

- UHIP is only for international students.

- New graduate students enrolled in May will not automatically have GSA Health/Dental Insurance Plan. You need to do self-enrollment by contacting macgsa@mcmaster.ca. Please refer to http://studentcare.ca/rte/en/McMasterUniversity_ChangeofCoverage_SelfEnrolment.

- International visiting students will not automatically have GSA Health/Dental Insurance Plan either. You need to enroll UHIP first before enrolling GSA Health/Dental Insurance Plan. Besides, you can only enroll yourself by contacting macgsa@mcmaster.ca during “Change-of-Coverage Period”, which is usually the first month of each term. Please refer to http://studentcare.ca/rte/en/McMasterUniversity_ChangeofCoverage_ChangeofCoveragePeriod

Opt-out

The insurances are mandatory for all students. You can opt-out only if you have already purchased the same insurance. Common scenarios are as follows:

- If you are a TA or RA in lieu, you are a member of the CUPE 3906. Members in CUPE have CUPE Unit 1 Dental Plan. You will automatically opt-out GSA Dental Insurance Plan.

- If you’re a part-time graduate students, you have a full-time job off-campus. Usually, large companies buy insurances for their employees, and you don’t need to buy GSA Health & Dental insurance. The university will charge those fees anyway, and students need to contact macgsa@mcmaster.ca to opt-out. Please refer to http://studentcare.ca/rte/en/McMasterUniversity_ChangeofCoverage_OptOuts.

- If you can join the similar health insurances with your family members, you also can opt-out like part-time students.

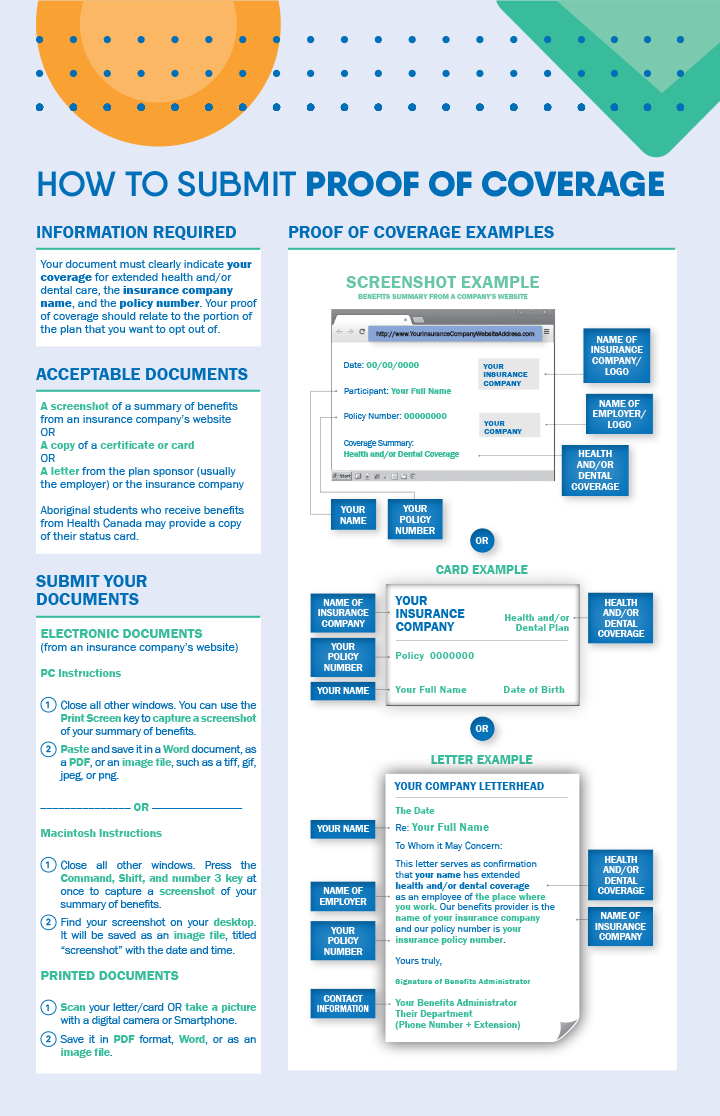

Here is the guide about how to prepare the documents for opting-out:

Change-of-Coverage Period

The Change-of-Coverage Period is the period at the beginning of the term when you can either opt out or enrol your spouse and/or dependent children in the GSA Health/Dental Insurance Plan. Period for different situations:

|

McGSA COC

|

Start

|

End

|

Note

|

|

Fall

|

Wed, Sep 3, 2025

|

Wed, Oct 1, 2025

|

Starts day after 1st day, open for 4 weeks, closes first business day after Sep 30th (holiday)

|

|

Winter

|

Tue, Jan 6, 2026

|

Fri, Jan 30, 2026

|

Starts day after 1st day, open for 4 weeks, closes first business day of the month

|

|

Summer (for self-enrolments only)

|

Tues, May 5, 2026

|

Fri, May 29, 2026

|

Starts first Tuesday of the month, closes last business day of the month

|

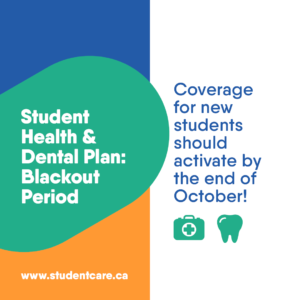

Blackout Period – Fall 2023

Are you a first-year covered by the Student Health & Dental Plan? While new student lists are being processed, you may experience a Blackout Period that will affect your ability to submit claims, use your Pay-Direct Card, or create an insurer account. No worries—you should be active around the end of October. You can still use your benefits in the meantime, just hold on to your claims until then!

Attention: Graduate students are required to ensure their mailing addresses are correct on the MOSAIC (https://mosaic.mcmaster.ca/) for Studentcare to mail cheques to them. For any lost or misplaced cheque, Studentcare will issue another cheque less the $25 administration fee. Besides, the request to opt out any insurance plan must be made in the current policy year and Studentcare will refund the relative fee by a cheque to the student once it is approved. Any late request to reissue lost or misplaced cheques will be rejected, as accounts will be reconciled and audited after each policy year.

See a Doctor

University clinics

Campus dentist

- Website: http://www.campusdentist.com/mcmaster.html

- Reservation: 905-526-6020 or mcmaster@campusdentist.com

Campus optical

- Website: https://www.campusdentist.com/campus-optical.html

- Reservation: (905) 525-9140 ext. 20889 or info@campusoptical.ca

Off-campus Dental, Vision and so on

Although the above 2 clinics are on campus and convenient, they are not in “Studentcare network”. You cannot get enough reimbursement. For example, you can only reimburse 70% of the dental cost in Campus dentist.

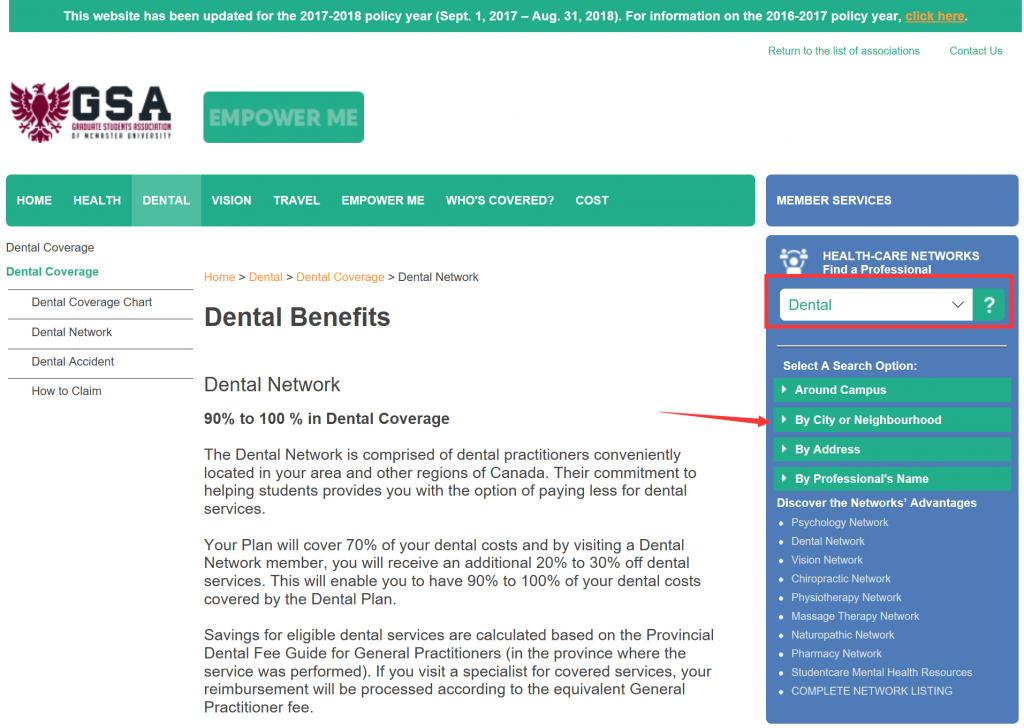

Find clinics in Studentcare network:

- Go to Studentcare website for GSA: https://studentcare.ca/rte/en/McMasterUniversity_Home

- Select “Dental“ or “Vision” or other services from the drop-down list under the heading “STUDENTCARE NETWORKS Find a Professional” on the upper right corner of the page.

- The dental clinic designated by the GSA Dental Insurance Plan is called “Studentcare Dental Network member”.

For general dental clinics, the GSA Dental Insurance Plan can reimburse 70% of the total cost. However, for “Studentcare Dental Network member”, the cost can be reimbursed for extra 20% to 30%. Thus, it can reimburse 90% to 100% of the total cost.

Prescription Drugs

McMaster University Centre Pharmasave

- Official website: https://universitypharmacy.ca/mcmaster/

- Location: Student Center Room 109B.

- If you need to buy prescription drugs as being told by a doctor in the student wellness center (SWC), you can go to this place as your first choice. The reason is that you can directly reimburse the cost while visiting. This will save the process of reimbursement by yourself.

Shoppers Drug Mart: https://www1.shoppersdrugmart.ca/en/health-and-pharmacy/pharmacy-services. As you can see from the name of the store, it is more than just a supermarket, but also a regular pharmacy.

Fortinos: https://www.fortinos.ca/pharmacy

Rexall: https://www.rexall.ca/pharmacy. Rexall is a pharmacy and retails some of the daily necessities. It is also in Studentcare Pharmacy Network, where you can get the following benifits:

- If you show Pay-Direct Card, you can enjoy an additional 10% discount on prescription drugs, which means you can reimburse for 90% of the cost. http://studentcare.ca/rte/en/McMasterUniversity_Health_HealthCoverage_PharmacyNetwork

- If you buy Rexall branded daily necessities in this store, you can enjoy a 20% discount by showing the “Rexall Exclusive Savings Card” and student ID card at checkout.

Other pharmacy locations: https://pharmasave.com/. Mobile app ” eCare@Pharmasave “:

In the event that the drugs covered aren’t effective in treating the condition, an exception process is in place. Download or print a Drug Exception Form here.

To find out if a specific drug is covered by the Plan, please log in to the Securian Canada Health Portal and check your drug coverage. See this guide on how to use the drug coverage search tool.

Reimbursement

All insurance services are provided by Securian, except that “Travel” in GSA Health Insurance Plan is provided by Blue Cross. Broker is the Studentcare. There are 3 methods for reimbursement:

Method 1: If a pharmacy accepts pay direct card (e.g. McMaster University Centre Pharmasave, Rexall, etc.), you can avoid the reimbursement process by showing that card. You only need to pay the part of the cost that cannot be reimbursed (usually 20%). Pay direct card can be found at

- mobile app: https://my.ihaveaplan.ca/index.html

- webpage: http://studentcare.ca/rte/en/McMasterUniversity_DownloadCentre_PayDirectCard

Method 2: Take a picture of all the documents (prescriptions, invoice and so on) by using “Studentcare” App and fill in the reimbursement information.

Method 3: Fill in the claim form and mail the relevant documents to the address on the form: http://studentcare.ca/rte/en/McMasterUniversity_Claims_HowtoClaim.

Need more help?

Studentcare website is a good place to start

- Member services is unique to our GSA plan

- Please do not call SunLife/Securian (our insurance provider) as they will not know the specifics of our plan

Visit the GSA office at the GSA Main Office (Mon-Thurs 10am – 1pm)

Send your questions to macgsa@mcmaster.ca

CUPE Health Insurance Benefits

Update for Health Care Spending Account (HCSA)

A Health Care Spending Account (HCSA) exists for all TAs and RAs (in lieu). As a result of our success with collective bargaining in late 2022, we have been able to expand the maximum entitlement for members. Collective Bargaining works! Effective January 30, 2023 (and backdated to September 1, 2022), the maximum entitlement is no $350 per twenty four month period. (This period is currently calculated retroactively from September 1st of the academic year in which you use up your entitlement. For example, if you make a $350 claim in November, 2021, the next time you will be eligible to make a claim will be September 1st, 2023, provided you are still a member/meet the eligibility criteria. The entitlement period is subject to change pending funding.) Previously, the maximum entitlement was $250 per twenty four month period.

The Health Care Spending Account (HCSA) enables members to claim a wide range of medical, dental and pharmaceutical expenses not covered (or inadequately covered) by OHIP, UHIP and student extended health plans administered by the GSA and MSU. Vision care products and services such as glasses, contacts and eye exams will remain eligible expenses.

Click here for a full list of HCSA eligible expenses determined by the Revenue Canada Agency. You can also visit the CRA’s list of authorized practitioners according to province here.)

**Please note that prescription eye glasses are on the eligibility list. They are listed by as: “Vision devices – including eyeglasses and contact lenses to correct eyesight – prescription required.” If you are only getting frames, you need proof from the optometrist that they inserted prescription lenses into the frames. (They should be able to indicate this on your receipt.)**

This benefit is open to ALL Unit 1 (Teaching Assistants or RA in lieu) members in good standing. If you hold a TA or RA in lieu contract for the 2022-2023 academic year (September 1st, 2022 to August 31st, 2023), you are be eligible to make a HCSA claim this academic year (provided you have not “maxed out” your entitlement in the past academic year).

Your eligibility for this benefit expires on August 31st of the current academic year, and will not be renewed in September unless you hold a contract for (or have a reasonable expectation to hold a contract for) the next academic year. (Please note there are some additional limitations to this eligibility period in very rare circumstances. If you have any questions, please contact administrator@cupe3906.org.)

To file a claim, fill out the form available at the Union office or on our website HERE (This form is a PDF that can be filled out on your computer.)

A Cheque will normally be mailed to the address provided on the claim form in about 4-6 weeks.

Please note that you must normally submit your HSA claim within 60 days of purchase of your health-related product or service. Some exceptions may be possible. For more information, contact administrator@cupe3906.org.

Gender Affirmation Fund for us

We are pleased to announce that we are now accepting applications for reimbursement through CUPE 3906’s first-ever Gender Affirmation Fund. We’d like to thank our sister Locals like CUPE 3902 and CUPE 4600, who have led the charge in providing benefits like these to academic workers at U of T and Carleton, respectively. Their own Trans Funds served as great examples after which we could model our own Gender Affirmation Fund. Many thanks, also, to the trans and nonbinary members of CUPE 3906 who assisted in the creation of this fund and the relevant application materials. Your input has been invaluable to ensuring that the Gender Affirmation Fund addresses the needs of those for whom this benefit is intended.

See below for a detailed overview of the Gender Affirmation Fund, including eligibility criteria and instructions on how to apply. The required claim form can be found .

WHAT IS THE GENDER AFFIRMATION FUND?

The Gender Affirmation Fund is a pool of money that was won by the CUPE 3906 Unit 1 bargaining team (representing TAs and RAs in-lieu at McMaster) in their most recent round of collective bargaining with the Employer. Now protected in Article 21 of the Collective Agreement, the Gender Affirmation Fund provides a total of $10,000 per year to help offset the costs involved with various elements of affirming one’s gender. The fund is officially defined by the Employer as a “supplemental benefits fund” that the Union can use “for supplementing benefits entitlements of employees or related purposes as determined by CUPE.” To this end, the Union has committed to dedicating the entirety of these $10,000 annual lump sum payments to supplemental benefits for our Two Spirit, trans, and nonbinary members. Put simply, the purpose of this fund is to help offset the costs associated with gender affirmation – including everyday, medical, administrative, legal, and other expenses.

WHO CAN ACCESS THIS FUND?

Any member of CUPE Local 3906, Unit 1 (TAs and Ras in-lieu) who identifies as Two Spirit, trans, or nonbinary.

HOW MUCH MONEY COULD I GET?

Given that the total amount of money in the fund ($10,000 per year) that we have to work with is still rather modest, there are limits on how much money any individual member can access. There are over 2 600 Unit 1 members who may be eligible for the fund, and we want to be as equitable as possible and need to balance a meaningful contribution to each person who needs to access the fund, while simultaneously ensuring that there is money in the fund when folks need it.

To this end, in March 2021, the benefits committee voted to increase the annual cap per member to $2000/academic year (September – August), while the lifetime cap is set at $4000. All claims are subject to availability of funds but we encourage interested members to apply for this fund. (To inquire about availability of funds please email benefits@cupe3906.org) We hope to increase these caps through future rounds of collective bargaining.

WHO ADMINISTERS THIS FUND?

In an effort to protect your confidentiality and make this fund available ASAP, all applications will go directly to our third-party benefits administrator, the Prosure Group, for review. We do hope to create a Gender Affirmation Fund Steering Committee in future years, through which Two Spirit, trans, and nonbinary people will adjudicate the applications; however, to create and rely on such a committee right now – in the context of COVID-19 – would likely cause further delays in getting these funds to our members.

Should the folks at Prosure have questions regarding your application, they may reach out to you directly for clarification. Other concerns may be relayed to our Equity Officer and Benefits Committee without the applicant’s name attached. We have a strong working relationship with Prosure and have brought our account representatives up to speed on the single criterion for eligible expenses, which is explained below.

Please note: You do not need to obtain an “Authorized CUPE rep signature” for the duration of our office closure.

WHAT COUNTS AS AN ELIGIBLE EXPENSE?

The financial costs associated with gender affirmation can vary greatly from person to person. That being said, the Union holds an expansive, open definition of what constitutes gender affirmation. There is no predetermined list of eligible or ineligible expenses for reimbursement through this Gender Affirmation Fund. Rather, the fund is intentionally designed to make accessible forms of gender affirmation that are often limited by the strict requirements of OHIP, the CRA, and other employment-based or public forms of funding for Two Spirit, trans, and nonbinary people. The only requirement is that the cost(s) for which you are seeking reimbursement be incurred for the purpose of affirming your gender identity, however you so choose. We have included some examples for your information below, but again, we wish to emphasize that this list is by no means exhaustive. If you are a Two Spirit, trans, or nonbinary Unit 1 member of CUPE 3906 and wish to seek reimbursement for an expense that is not listed below but was nonetheless incurred as a means of affirming your gender identity, we would strongly encourage you to submit an application.

Some examples of eligible expenses include:

(1) Everyday purchases associated with gender affirmation, such as:

– new wardrobe

– binders

– shapewear

– packers

– makeup

– wigs

(2) Medical procedures, pharmaceuticals, and therapies associated with gender affirmation, especially those not sufficiently covered under the member’s existing health and public insurance plan(s). For example:

– gender-affirming surgeries, including gender-affirming cosmetic surgeries

– hormone replacement therapy (H.R.T.) prescriptions

– fertility treatments

– resilience therapy/gender counselling

– voice/speech therapy

– laser/other forms of hair removal

– For Two Spirit members, this might also include supports accessed through community Elders and traditional medicines (e.g. participation in Two Spirit gatherings, and related travel costs).

(3) Administrative costs associated with changing one’s legal name and/or listed gender marker through the required government channels, and reissuing any official documentation/forms of identification to reflect said change(s). Examples of documentation for re-issue may include, but are not exclusive to:

– passports

– health cards

– driver’s licenses

– debit and credit cards

– academic documents (diplomas, transcripts, awards, etc.)

(4) Costs incurred as a result of transphobic/transmisogynist violences. For example:

– moving expenses

– travel

– legal funds and advice

(5) Procedures for body dysmorphia

- body sculpting

- fat reduction in chest

- etc.

HOW DO I APPLY FOR REIMBURSEMENT THROUGH THE GENDER AFFIRMATION FUND?

By filling out THIS FORM (please note that, as per above, the yearly limit is $2,000 per member and the lifetime limit per member is $4,000). All applications must include the completed form with the applicant’s signature, as well as any supporting documentation specified therein (e.g. receipts or invoices). You should then submit your complete application package, ideally as a single document, by email to claims@prosure-group.com.

You may also send a hard copy of your application to the Prosure Group via mail; however, email applications are preferred and likely to be processed faster given the circumstances of COVID-19. Should you choose to apply by mail, the address is below:

THE PROSURE GROUP

2255 Sheppard Avenue East

SUITE 202, Atria 1

Toronto, ON M2J 4Y1

IF MY CLAIM IS ACCEPTED, HOW WILL I GET MY MONEY?

Either by mailed cheque or by direct deposit. Should you choose direct deposit, be sure to submit the additional required paperwork described on the claim form.

QUESTIONS, CONCERNS, SUGGESTIONS, OR OTHER COMMENTS?

Email us! This is our first time offering the Gender Affirmation Fund and we welcome all feedback, particularly from Two Spirit, trans, and nonbinary people. You can reach our Equity Action Officer at equity@cupe3906.org. Where applicable, your feedback will then be relayed to our Benefits Committee and/or the Prosure Group.Health insurance information -Reproductive Health Fund

Under the Reproductive Health Fund, CUPE 3906 Unit 1 members (TAs and RAs in lieu) are able to claim up to $150 in reproductive health related expenses per academic year. These expenses include but are not limited to, menstrual products, HPV vaccines, prenatal vitamins, OTC Plan B, IUD insertions, transportation to and from reproductive healthcare services etc. As with our Gender Affirmation Fund, we recognize that the financial costs associated with reproductive health may vary greatly from person-to-person.

The Benefits Committee remains committed to working closely with members of the Women’s Committee and Equity Committee to provide fair and equitable access to this fund. If you would like to be a part of this process please reach out to womenscommittee@cupe3906.org or benefits@cupe3906.org

Please CLICK HERE for the claim form.